Embezzlement, Part 1 – Is your practice at risk?…

By definition, embezzlement is the act of dishonestly appropriating assets by one or more individuals to whom such assets have been entrusted. It may range from the minor, involving only small amounts of money, to the immense, involving large sums and sophisticated schemes.

Embezzlers conceal their activities from other individuals, only taking a small portion of the funds received, in an attempt to minimize the risk of detection. If successful, embezzlement may continue for years without detection. Victims typically realize the funds are missing when they need to access the money and its not there.

According to the Association of Certified Fraud Examiners, 3 out of 4 physicians will suffer a significant loss due to theft during their careers. It is not enough to just make money … you must protect it once it enters the practice.

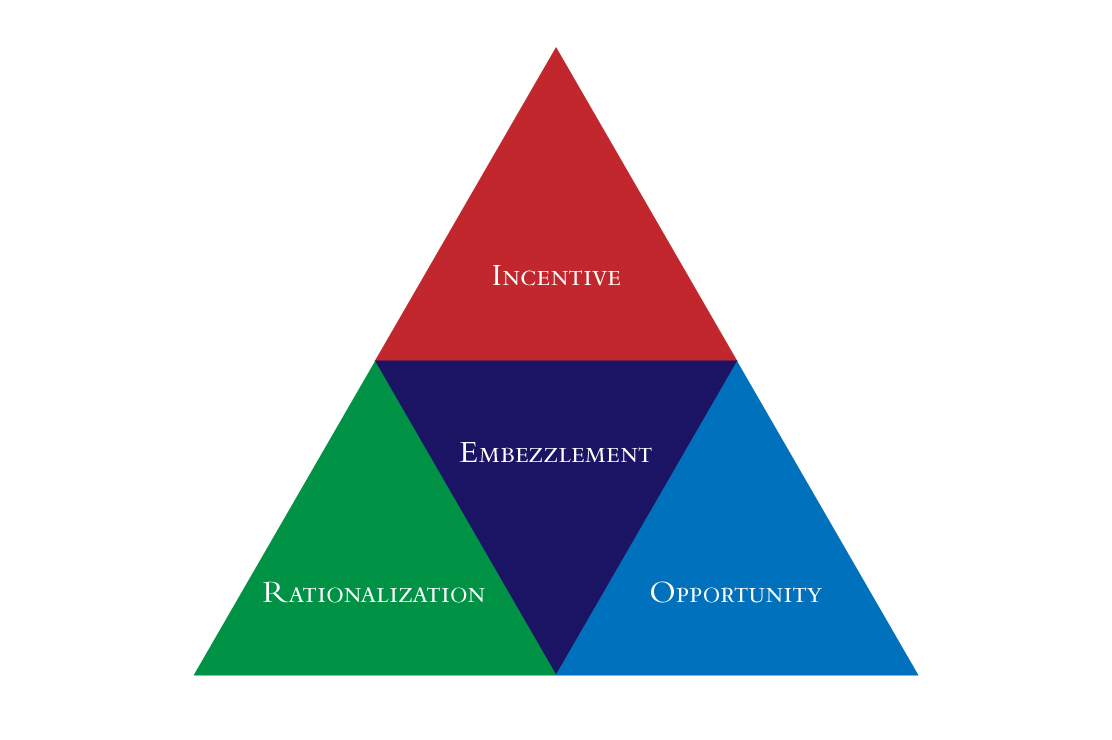

Since embezzlement is fraud frequently perpetrated by trusted employees, it is important for owners to remain objective and aware. In the 1940s researcher Donald R. Cressy developed the “fraud triangle” to describe the three elements required for someone to commit fraud: employee “need” + rationalization + opportunity = workplace fraud.

Embezzlement Triangle

Cressy’s “fraud triangle” concept applies in medical practices today. Employee “needs” are a driving force in premeditated embezzlement. These needs may be real (house mortgage, college tuition, medical bills) or perceived (expensive lifestyle, substance abuse/addition.) Either way, they can lead an employee to consider practice funds a source to fulfill their needs.

But how do employees take practice funds without you knowing? It comes down to employee access. Without an internal system of checks and balances, the opportunities for employee embezzlement abound:

- Pocket Cash – The bulk of thefts occur at the front desk. In this age of higher copays and deductibles, employee pockets the cash received from patients prior to appointments.

- Bad Checks- Employee writes out check to pay personal bills and records it into the practice books as a legitimate practice expense

- Secret Bank Accounts- Employee opens a new account in the physician’s name, deposits funds into it with a signature stamp, and treats it as his own. The physician never knows this account exists.

- ATM – Employee takes falsified refund checks and deposits into their own accounts through their ATM (no bank teller to review)

- Invisible write off – Employee cashes checks themselves, or takes cash payments, and makes those “disappear” by writing it off on patient accounts.

- Office Pilferage – Employee uses postage, makes personal copies, falsifies time cards, places long-distance personal calls, and/or takes medical supplies, medications and medical equipment. These “small” thefts amount to significant losses over time.

Once victims get over the initial “shock” of being robbed, they often wonder why an employee would jeopardize their job, career and reputation, and how that same employee would think that embezzling is “OK.”

Employee rationalization includes:

- Jealousy over the physician’s earning capacity. We strongly recommend that physicians not discuss their personal finances with the staff, including asking employees to do personal banking or investing for the physician.

- Entitlement brought on by an employee feeling under-appreciated. “I deserve this because..” I work long hours for which I’m not compensated and the doctor(s) never even say thank you.

- Denial that what employee is doing is wrong. In this situation, embezzlement may start small because it was convenient and seemingly insignificant, and increases in scope over time.

Small and medium-size practices are particularly prone to employee embezzlement because they have fewer employees to divide and assign duties. By default, one individual may take the lead on all financial matters, thereby jeopardizing the practice.

One solution is outsourcing to an objective and highly regarded billing company, you may minimize that risk. If you prefer to keep these tasks “in-house”, next month’s blog will address specific procedures and solutions you may employ to safeguard your revenue – so be sure to check back here!

3 Responses to “Embezzlement, Part 1 – Is your practice at risk?…”

Leave a Reply

Latest Posts

- June 1, 2022 | By: admin

7 Benefits of Outsourcing Medical Billing

Medical billing can be a difficult and challenging task for medical practices. Most physicians or … Read more »

- May 9, 2022 | By: admin

Start a Successful Patient Email Marketing Campaign

For any healthcare provider who wants to grow their practice, practice marketing is key. In this day… Read more »

- March 14, 2022 | By: admin

HIPAA Guidelines – Why you should not use Skype, Email or Facetime for communicating with your patients

The HIPAA guidelines on telemedicine affect any physician who provides a remote service to patients … Read more »

- January 11, 2022 | By: admin

Is Everyone in Your Practice Fulfilling their Role in the Revenue Cycle?

There is no one, and I do mean no one, in your medical practice who does not have a serious impact o… Read more »

- September 10, 2021 | By: admin

Embezzlement – Part 2 – How to protect your practice….

Last blog post we discussed the significant risk of embezzlement that is posed to small and medium m… Read more »

- July 1, 2021 | By: admin

Updates on Telemedicine – Is it Time to Jump In?

The sustainability of the traditional office provider-based model is being continually challenged by… Read more »

- June 5, 2021 | By: admin

Embezzlement, Part 1 – Is your practice at risk?…

By definition, embezzlement is the act of dishonestly appropriating assets by one or more individual… Read more »

- April 20, 2021 | By: admin

What Providers Need to Know About COVID-19 Coding and Billing

By Jacqueline LaPointe The COVID-19 pandemic is putting strain on the healthcare system, but accura… Read more »

News

- June 2, 2016 | By: Ami Tucker

HCMS wins prestigious award

Best Web Presence: Healthcare Management Systems has the best web presence with an easy-to-navigate … Read more »

Do you think members of a medical practice billing department could deposit checks from patients into their own accounts? Or from insurance checks sent to patients, and endorsed over to the practice??

Absolutely! They can and the DO. This is often how we acquire new clients – they realize something is “off” with their in house billing department and come to us for help. A small practice needs checks and balances in place to prevent embezzlement and they are so busy trying to do everything a small practice needs to do, that they often overlook this piece of the business.

I think this can happen in larger practices as well. Ami, would you mind emailing me or calling me tomorrow with your contact information? rsmith718@optonline.net. 631-921-4560.

Thank you